After issuing a comprehensive Rebrand RFP in late 2013, Kennedy Space Center Federal Credit Union awarded this project to us in early 2014. After undergoing our “Building the Foundation” process, Kennedy Space Center FCU became Launch FCU in mid-2014, and in early 2015 we took their new website—reflective of this new brand—live.

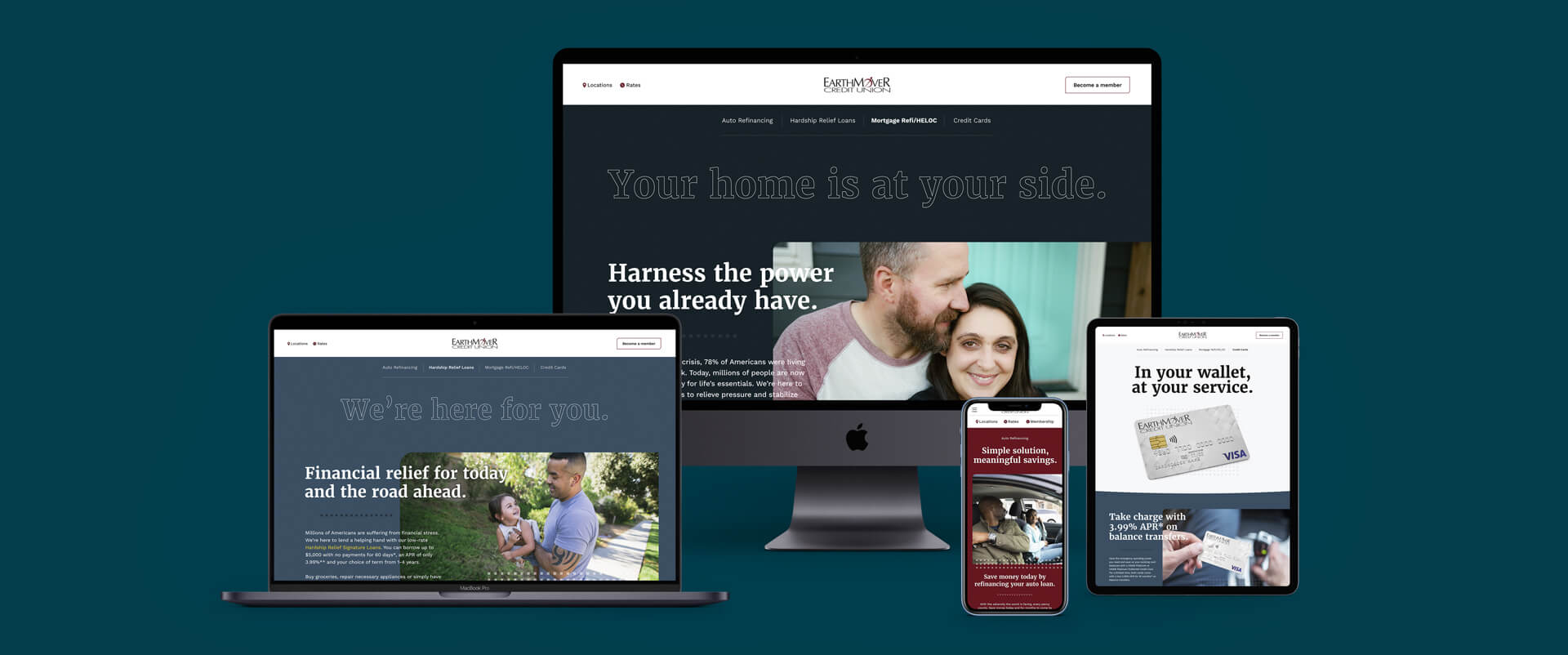

By late 2019, it had been nearly five years since Launch last had a significant change in their website. And, let’s face it. That’s an eternity in the realm of web design. With monthly site visits surpassing 210,000 by late 2019, it was time for a comprehensive and strategic overhaul. Concurrently, the credit union had decided to transition from a federal to a state charter, which also entailed some serious strategic thinking.

Launch brought us in for both projects because they knew that in keeping with the credit union’s own tagline (also developed by us in 2014), we would indeed “Go Beyond” for them.

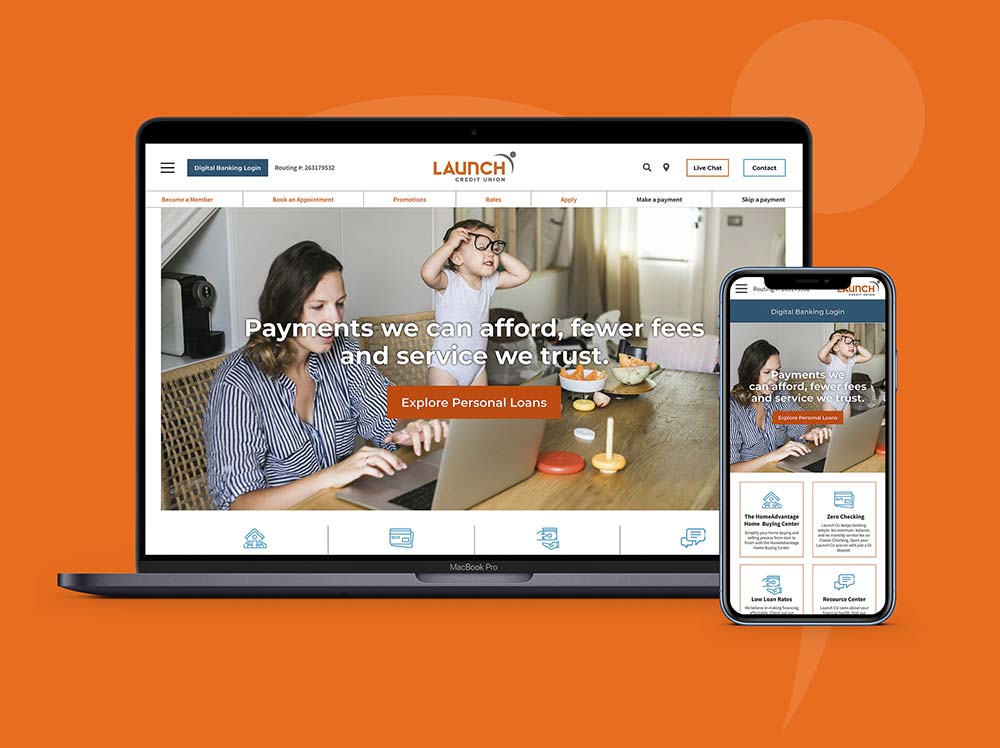

First, we tackled the name change to Launch Credit Union (dropping Federal) and the subsequent brand updates it entailed. By designing a “unique, but familiar” take on the original logo, the result is now a simplified, yet strong, variation of that original logo redesign. From this process, the direction the website redesign needed to go was made clear.

Where the old website had reinforced the brand in bright and bold ways, this redesign ushers in restraint—more white space and an airier design—while effectively expanding the design to be more device-inclusive, and highlighting its mobile responsiveness. It is, of course, fully ADA compliant.

Having hosted and managed their website these last five years, we also knew that most website updates are performed by Launch staff members, which meant making sure that the content management system was fully customized to meet their technical needs while not being overly complicated to use. Bottom line: The CMS needed to be robust, functional and intuitive.